Updated at 7:05 p.m. ET on 2024-12-03

Indonesia’s decision to play hardball with Apple Inc. by banning the iPhone 16 because it failed local sourcing requirements had left many analysts saying the move may alienate foreign investors, but Jakarta may just have the last laugh.

The Indonesian investment minister said that the American tech giant had now verbally committed to invest U.S. $1 billion in the country and he expected to approve the investment and send it to the Ministry of Industry in about seven days.

“We’ve discussed this, and … for the first phase, I will obtain a written statement from them committing to an investment of $1 billion,” Rosan Roeslani, the investment minister, told the House of Representatives, according to a recording of parliamentary proceedings posted on YouTube.

“[H]opefully, within a week, I can … submit it to the Ministry of Industry,” he added.

If it materializes, Apple’s $1 billion investment would be 10 times the $100 million it offered on the second occasion it sought to reverse the Oct. 27 ban. Apple’s first offer was even more paltry – $10 million, Bloomberg news had earlier reported.

Jakarta had rejected both offers.

Rosan told lawmakers on Tuesday that he hoped the Silicon Valley firm’s investment would generate more jobs in Indonesia.

“Frankly, their investment is still very small, extremely small. I’ve told them that their investment needs to be larger because they’re only reaping benefits through iPhone sales,” he further told members of the House.

“We just want to ensure fairness. If they’re benefiting here, then they should invest here as well, creating jobs too.”

Indonesia had banned sales of the iPhone 16, which was launched globally Sept. 20, saying that Apple had not fulfilled a 2017 requirement, which mandates that 40% of smartphones sold in the country use locally sourced parts.

The policy was designed to boost domestic manufacturing and reduce reliance on imports, but enforcement was uneven, allowing some global companies like Apple to skirt compliance through workaround measures.

Under President Prabowo Subianto, who took office on Oct. 20, the policy has gained new momentum.

The government sees the local content policy as a tool for creating jobs, strengthening supply chains, and reducing Indonesia’s trade deficit.

Apple did not respond to a request from BenarNews for comment.

‘It’s baffling’

Aryo Meidianto Aji, a senior consultant and smartphone market analyst at Reasense Research, said the government’s hardball tactics against the tech giant were long overdue. He spoke to BenarNews before reports about Rosan’s announcement regarding Apple’s $1 billion offer.

“This step is one we’ve been waiting for,” Aryo told BenarNews, referring to the government’s ban and rejections.

“For years, the government has been inconsistent in dealing with Apple.”

While other foreign smartphone manufacturers such as Samsung and Oppo have maintained assembly operations in Indonesia, Apple opted for software partnerships with local firms.

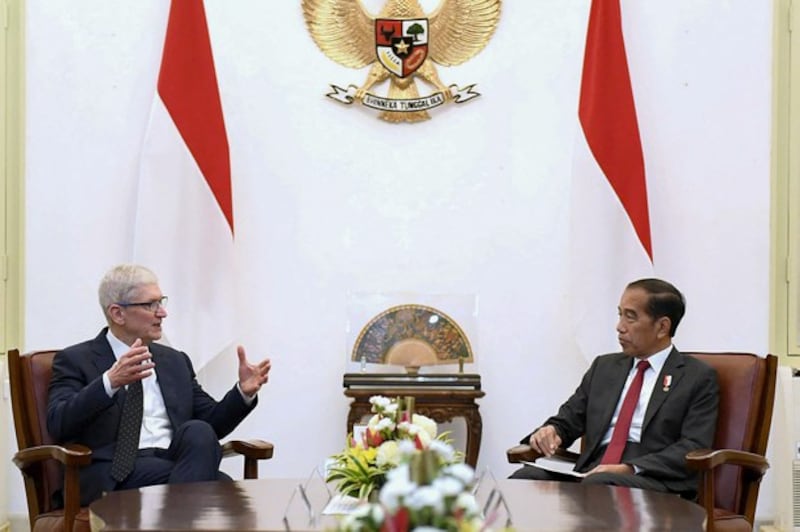

This approach satisfied regulators under Joko “Jokowi” Widodo, Prabowo’s predecessor, but has been deemed inadequate by the new administration.

Additionally, Aryo said, Apple’s reliance on authorized distributors rather than direct manufacturing or representation has complicated compliance.

“Distributors … aren’t the manufacturers or the brand owners. It’s bizarre to expect them to fulfill technical requirements such as 5G network testing,” Aryo told BenarNews.

He criticized Apple’s minimal contribution to meeting the requirement.

“It’s baffling. When Apple announces investments in factories or facilities, they often fall short of addressing unmet commitments from prior agreements,” he said.

By comparison, South Korea’s Samsung and China’s Xiaomi had invested 8 trillion and 5.5 trillion rupiah, respectively, in manufacturing in Indonesia, local media quoted Indonesian Industry Minister Agus Gumiwang Kartasasmita as saying last month.

‘Expectations for equitable contributions’

Apple has not fulfilled last year's investment target of 1.71 trillion rupiah ($107 million), which was why Indonesian rejected its $100 million investment proposal as well, which included plans for a component and accessory plant.

The iconic company holds a relatively smaller share of the Indonesian market, estimated at around 3%, due in part to its higher price points.

However, in the premium segment of smartphones priced above $500, the iPhone leads with a 60% market share.

Oppo, a Chinese smartphone maker, held the largest market share in 2023, with around 19% of the market, followed closely by Samsung with approximately 17%, according to Counterpoint, a market research company.

Vivo and Xiaomi, both Chinese brands, command roughly 16% and 15%, respectively.

For Apple, non-compliance with Indonesia's regulations could mean losing ground in one of Southeast Asia’s largest and fastest-growing economies, where a burgeoning middle class drives smartphone sales.

Indonesia’s demands come as Apple has ramped up production facilities in other Asian countries such as Vietnam and India, so it can diversify its supply chain.

And because Apple’s presence in Indonesia is limited to sales and marketing, the government had suggested that building a factory would eliminate the need for frequent investment negotiations.

Some analysts warned, though, that overly protectionist measures may cause inefficiencies and make domestic businesses complacent.

Hasran, a researcher at the Center for Indonesian Policy Studies (CIPS), told BenarNews that the local components requirement could, on occasion, force businesses to buy expensive domestic materials versus affordable imports.

“This ultimately drives up prices. To produce competitive products, industries need flexibility in sourcing high-quality, cost-effective inputs,” said Hasran, who goes by one name.

“[Besides], when local firms feel protected, they may lose motivation to innovate or compete globally.”

However, there could be other opportunities that might mitigate this potential problem, Investment Minister Rosan’s comments to lawmakers indicated.

“Typically, when one major player moves, it creates a trickle-down effect, encouraging their suppliers as well to invest in Indonesia," he said.

“This is what we’re aiming for.”

Ismira Lutfia Tisnadibrata in Jakarta contributed to this report.