Southeast Asian countries wanting to join or partner with the China- and Russia-led BRICS bloc may want to think twice after U.S. President-elect Donald Trump threatened to impose massive tariffs on nations that weaken the American dollar, analysts say.

Several Southeast Asian nations have shown an interest in joining BRICS, which stands for Brazil, Russia, India and South Africa. Four recently became BRICS partner countries.

The grouping sees itself as an alternative to a Western- or United States-dominated world economic order.

A U.S. tariff overload due to a perception that Southeast Asian countries support a new BRICS currency or global payment system is a real threat for the region, which already has to contend with a potential trade slowdown, according to regional experts.

Apart from warning against a BRICS currency, the incoming American president has pledged to tax all imports by 10-20%.

Complacency because Trump did not act on all his threats during his 2017-2021 presidency would be a bad idea for countries in the region, said Doris Liew, a Malaysian economist.

"Southeast Asia could face U.S. trade retaliation if its nations align too closely with BRICS initiatives, especially under a Trump’s administration that perceives BRICS as a direct challenge to U.S. dominance,” said Liew, with the Institute for Democracy and Economic Affairs in Malaysia.

“While Trump’s past tariff threats were not always acted upon, his transactional approach to diplomacy makes such measures credible, particularly if BRICS activities escalate efforts to undermine the U.S. dollar.”

Trump posted his latest warning on social media site Truth Social over the weekend.

“We require a commitment ... that they will neither create a new BRICS currency, nor back any other currency to replace the mighty U.S. dollar or, they will face 100% tariffs,” he said.

“There is no chance that BRICS will replace the U.S. dollar in international trade. Any country that tries should wave goodbye to America.”

Dissatisfaction with the dollar’s dominance has grown in response to U.S. sanctions on countries such as Russia.

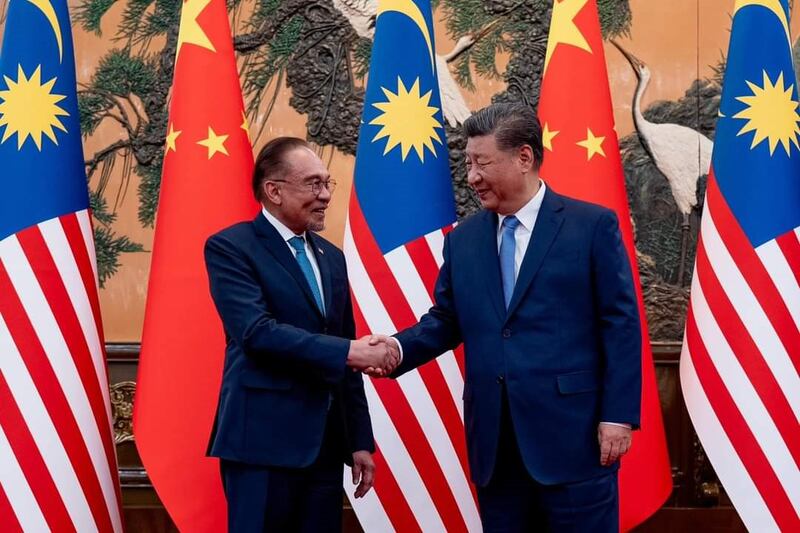

Some leaders, including Malaysian Prime Minister Anwar Ibrahim and Russian President Vladimir Putin, have called such moves Washington’s “weaponization” of the dollar.

Advocates of a proposed BRICS currency – often referred to as “The Unit” or “Unit” – frame it as a counterbalance to American-led financial systems.

And proponents of the potential currency argue that if backed by gold or other commodities, it could provide an alternative for international trade settlements.

However, a unified BRICS currency faces hurdles and is unlikely to materialize any time soon, analysts mostly agree.

BRICS’s now 10 member-countries may have a few similar interests and like the idea of an international currency they can control better, but in reality they have very different economies, according to a wealth manager for U.S. firm Mercer Advisors.

“It’s not a foregone conclusion that the countries involved can pull this off,” David Krakauer, senior director, portfolio management, wrote in an explainer on the firm’s website Oct. 9.

“Even if they would all prefer an alternative to the U.S. dollar, these aren’t necessarily countries that otherwise have overlapping interests when it comes to their currencies.”

A unified BRICS currency faces other obstacles, including the need for coordinated monetary policies, said Mihaela Papa, a BRICS expert at MIT’s Center for International Studies.

“Developing a joint currency … on a large scale is a lengthy process, making it unlikely the dollar will face a significant challenge soon,” Papa told BenarNews.

The U.S. dollar remains the dominant global reserve currency, accounting for 58% of foreign reserves worldwide, according to the Atlantic Council, a global policy think-tank. The euro, the currency in second place, is far behind, accounting for only 20%, International Monetary Fund data showed.

Another analyst, Ahmad Mohsein Azman of political risk consultancy BowerGroupAsia, said it was more likely that Southeast Asian countries would maintain the status quo in the near term.

"Countries like Malaysia and Vietnam have garnered the attention of the U.S. due to their trade surplus position, largely due to the countries' involvement in the semiconductor supply chain," he told BenarNews.

“With or without BRICS, these countries [would] still be in the U.S.’ sights for [potential] trade retaliation.”

‘Need to engage all countries’

Even though a BRICS currency may not become a reality now or later, many of its members, partner-nations and supporters are already working towards reducing their reliance on the greenback and contemplating building alternative financial systems, BRICS expert Papa said.

In Southeast Asia, Malaysian PM Anwar has made no secret of his firm support for BRICS.

A BRICS partner-country, Malaysia will take on the rotating chair of the ASEAN bloc in January, placing it squarely within the fallout zone of any economic or trade conflict between the U.S. and BRICS nations.

Perhaps that explained the cautious response from Tengku Zafrul Aziz, Malaysia’s investment, trade and industry minister, who on Tuesday said Trump’s “tariff threats” would be monitored.

"I think we have to watch closely what the potential developments are that may affect not just BRICS countries," state-news agency Bernama quoted him as saying.

"Malaysia, like I said, we are open for business. We are open for trade and we believe that we need to engage all countries."